Selling your Vermont multifamily investment property can be a strategic move, especially when you consider seller financing as an option. Also known as owner financing or seller carryback, this arrangement allows you, the seller, to provide financing directly to the buyer, bypassing traditional bank mortgages. Instead of receiving the full payment upfront, seller financing enables you to benefit from monthly cash flow while limiting your tax liabilities. This method offers flexible terms, additional interest income, and potential tax benefits tailored to Vermont property owners.

Let’s dive into how seller financing works and explore why it’s advantageous, particularly when selling multifamily properties in Vermont.

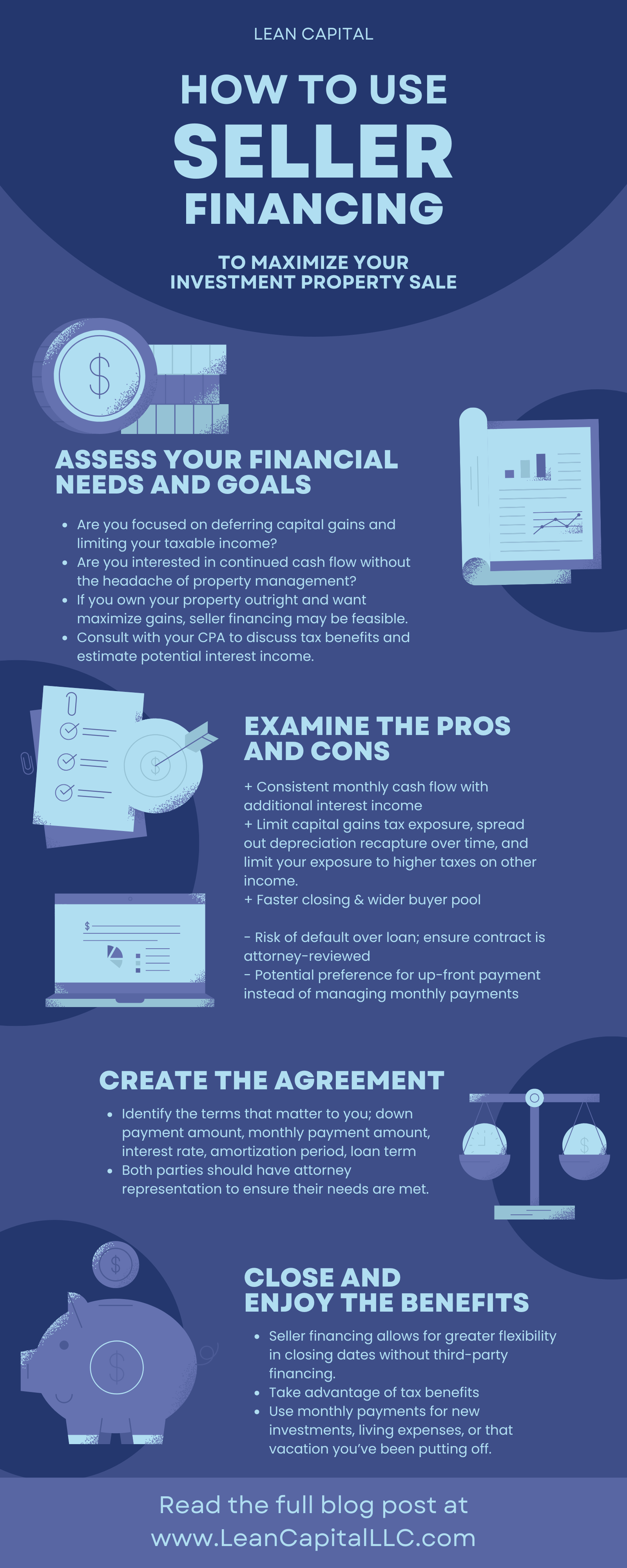

Assessing Your Financial Needs and Goals

Before committing to seller financing for your Vermont property, it’s important to have a clear understanding of your financial situation and future goals. Here are some key factors to consider:

- Determine Your Cash Requirements: Do you need immediate liquidity to pay off existing mortgages or fund new investments? Knowing this figure helps you decide on an appropriate down payment.

- Evaluate Your Income Preferences: With seller financing, you can create a monthly income stream. Would you prefer a larger down payment and smaller monthly payments or the reverse? Customize your payment structure to match your long-term goals.

- Project Financial Outcomes: Use financial tools or consult with a local Vermont advisor to estimate potential returns from seller financing, including interest income and tax benefits. Compare this with a traditional sale to determine the best approach for your circumstances.

Creating a Seller Financing Agreement

A well-structured seller financing agreement is essential for a successful transaction. Here’s what to include:

- Principal Amount: This is the sale price minus the down payment. The amount financed should be adjusted to your financial needs and the buyer’s capacity.

- Interest Rate: Set a competitive interest rate that benefits both you and the buyer. The interest payments create an additional income stream over time, increasing your overall returns.

- Repayment Schedule: Payments can be scheduled monthly, quarterly, or however it fits both parties’ needs, ensuring steady monthly cash flow.

- Loan Term: Decide on a loan term that suits your financial goals. Shorter terms offer quicker liquidity, while longer terms provide extended income.

- Collateral: Ensure the property serves as collateral, securing the deal in case of default.

- Prepayment Options: Allowing early payoff can benefit both parties, adding flexibility.

Tip: Consulting with a Vermont real estate attorney is wise to ensure your agreement protects your interests while accommodating the buyer’s needs.

Benefits of Seller Financing in Vermont

Seller financing offers several advantages, especially for property owners in Vermont looking to optimize their financial outcomes. Here are the key benefits:

- Monthly Cash Flow: Instead of receiving a lump sum, you’ll enjoy regular, predictable payments that can provide a steady income stream for years. (without the general maintenance of owning property)

- Limited Exposure on Capital Gains: Spreading out payments can help reduce immediate capital gains tax, keeping your liability manageable. In Vermont, this can significantly lower your overall tax burden.

- Limit Exposure to Higher Taxes on Other Income: Seller financing allows you to spread out taxable income over several years, avoiding a large tax bill in one year that could push you into a higher tax bracket for other sources of income.

- Additional Income from Interest Payments: You’ll earn interest income on the loan, enhancing your financial return while maintaining control of the transaction.

- Depreciation Recapture Spread Over Time: When selling a property, depreciation recapture can result in substantial tax obligations. However, with seller financing, this is spread out over the loan term, softening the tax impact.

- Attract More Buyers: Offering seller financing can appeal to buyers who may not qualify for traditional financing, expanding your potential buyer pool and speeding up the sale process.

- Faster Transactions: Bypassing the traditional mortgage process can lead to quicker closings, helping you generate cash flow sooner and reinvest profits more efficiently.

Potential Drawbacks of Seller Financing

While seller financing offers numerous benefits, it’s important to recognize potential challenges:

- Risk of Default: There’s always the chance the buyer may default on the loan. Thoroughly vetting buyers and including protective terms in your agreement can mitigate this risk. (they may receive a ton of equity though).

- Ongoing Management: Managing payments and paperwork can be time-consuming. You may want to hire an attorney or accountant to handle administrative tasks.

- Lower Immediate Sale Price: You might accept a lower sale price upfront in exchange for long-term financial benefits like interest income and tax savings.

Conclusion

Selling your Vermont multifamily property through seller financing offers a unique opportunity to maximize financial returns while spreading out tax liabilities and earning interest income. By crafting a thoughtful financing agreement, assessing your financial goals, and taking advantage of the flexibility seller financing offers, you can make a well-informed decision that aligns with your long-term objectives.

At Lean Capital, we specialize in helping Vermont real estate investors navigate the complexities of seller financing. Whether you’re currently selling a multifamily property or simply exploring your options, our team is here to guide you through every step of the process. Visit us at www.leancapitalllc.com to learn more about how we can help you make the most of your property sale. Let us take the stress out of seller financing, so you can focus on your future.

By emphasizing monthly cash flow, tax benefits, and increased flexibility, seller financing offers a smart way to sell your VT real estate. If you find this guide helpful, be sure to share it with fellow investors or anyone considering selling property in Vermont! For more insights, subscribe to our social media pages for the latest in Vermont real estate.