Managing residential rental security deposits can be challenging, especially in cities like Burlington, Vermont, where specific regulations apply. For landlords and property managers, understanding and complying with these local rules is essential not only to avoid potential legal issues but also to maintain positive relationships with tenants. Failing to adhere to these regulations can lead to disputes, penalties, and even damage to your reputation as a landlord.

Let’s dive into the essential steps and requirements for handling security deposits in Burlington to ensure a smooth process for both you and your tenants.

Legal Disclaimer:

The information provided in this blog post is for general informational purposes only and does not constitute legal advice. Landlords and property managers should consult with a qualified attorney or legal professional for advice tailored to their specific circumstances. For additional resources and support in managing rental properties, consider reaching out to the Vermont Landlord Association at www.vtlandlord.com.

1. Security Deposit Return Timeline

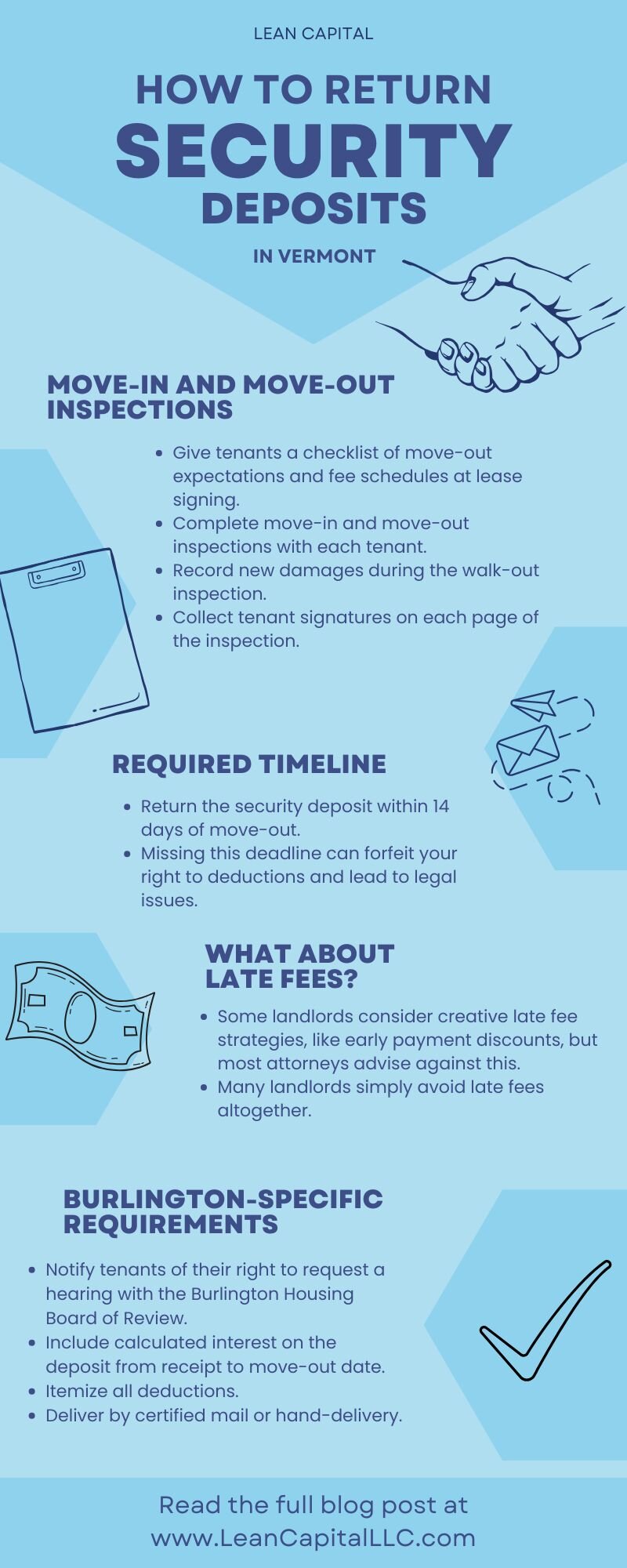

Once a tenant vacates your property, Vermont landlords are required by law to return the security deposit or provide an explanation for any deductions within 14 days. This process involves sending a written letter to the tenant, outlining the return of the deposit or detailing any deductions you’re making for damages or unpaid rent.

Timeliness is critical here. Failing to meet this 14-day deadline can lead to legal issues, including the forfeiture of your right to withhold any part of the security deposit. Moreover, it could negatively impact your relationship with the tenant and your reputation as a responsible landlord.

2. Handling Late Fees

In Vermont, it is recommended to keep late fees entirely out of security deposits. While some landlords might explore creative ways to impose late fees—such as offering rent discounts for early payments—most attorneys strongly advise against these tactics. These strategies often present more risk than reward, potentially leading to disputes or legal complications.

Many legal professionals recommend avoiding late fees altogether due to the regulations around them in this state. Charging late fees can strain tenant relationships and attract legal scrutiny, which may not be worth the potential hassle. Instead, clear communication about rent due dates and offering flexible, convenient payment options can help prevent late payments without relying on penalties.

By steering clear of late fees, landlords can maintain smoother, more compliant operations and avoid unnecessary legal risks.

3. Conducting & Documenting Inspections

One of the most critical steps in protecting yourself as a landlord is conducting a thorough move-in inspection with your tenant. This inspection should document the condition of the property at the start of the lease, noting any pre-existing damages or issues.

The move-in inspection report is an essential document for determining the validity of any deductions from the security deposit at the end of the lease. By clearly documenting the property’s condition, you protect yourself from unfounded claims and ensure that tenants understand any deductions made when they vacate.

4. Burlington-Specific: Tenant’s Right to a Hearing Request

If you are a landlord in Burlington, there are additional requirements you must follow. When sending the security deposit return letter, you are required to notify the tenant of their right to request a hearing before the Burlington Housing Board of Review within 30 days of receiving the deposit return letter.

The hearing process is designed to give tenants a formal avenue to dispute any deductions or the amount returned. Failing to notify tenants of this right can open you up to legal challenges and strain tenant relationships. By adhering to this step, you promote transparency and demonstrate a willingness to operate within Burlington’s regulations.

5. Burlington-Specific: Including Interest on Security Deposits

Burlington landlords are also required to pay interest on residential security deposits. From the day you receive the deposit until the day it is returned, you must calculate and include interest in the final amount given back to the tenant. This requirement is in place to compensate tenants for the time their deposit was held during the tenancy.

Make sure to accurately calculate this interest and add it to the returned deposit amount. Failing to include this interest could result in disputes or legal action, as tenants are entitled to this compensation under Burlington’s local laws.

6. Burlington-Specific: Itemizing Security Deposit Deductions

Transparency is key when it comes to security deposit deductions. Burlington landlords must provide an itemized list of all deductions made from the security deposit. This list should accompany the security deposit return letter and clearly explain why each deduction was made.

Providing an itemized list fosters trust and transparency, reducing the likelihood of disputes. Tenants are more likely to accept deductions when they are thoroughly documented and explained, rather than receiving a vague or unclear summary.

7. Burlington-Specific: Delivery via Certified Mail or Hand-Delivery

To ensure tenants receive their security deposits in a timely manner, Burlington requires landlords to send the deposit and the accompanying letter via certified mail or to hand-deliver them. This process ensures that there is an official record of the delivery, which can be invaluable if any disputes arise in the future.

By using certified mail, you’ll receive a receipt and proof of delivery, which can serve as evidence if a tenant claims they did not receive the deposit or the notice. Be sure to keep this receipt in your records to safeguard against potential disputes.

Why Compliance Matters

Staying informed about Vermont’s specific security deposit regulations is crucial for landlords and property managers. By following these steps, you can effectively manage security deposits while protecting yourself from legal challenges. More importantly, compliance helps foster better relationships with your tenants, showing them that you operate fairly and transparently.

To further familiarize yourself with your obligations as a landlord, we highly recommend consulting the Vermont Tenant-Landlord Handbook, which offers a comprehensive guide to renting in Vermont. Additionally, for more in-depth legal references, landlords can review the applicable sections of the Vermont Statutes to ensure full compliance with state laws. Of course, we always recommend reaching out to your own attorney for tailored advice to help you navigate any specific concerns or challenges.

The complexities of Burlington’s rental regulations may seem daunting, but by remaining diligent and organized, you can ensure smooth and efficient property management.

How Lean Capital Can Help Vermont Multifamily Property Owners

Owning multifamily investment properties can be rewarding, but it also comes with its share of headaches—from dealing with tenants and maintenance to managing complex regulations. If you’re a Vermont landlord who’s tired of the day-to-day demands and looking for a way to move on from property ownership, Lean Capital offers a hassle-free solution.

At Lean Capital, we specialize in purchasing multifamily properties directly from landlords like you. Whether you’re looking to streamline your portfolio, reduce your management responsibilities, or simply cash out of your investment, we can help. Our team ensures a smooth, straightforward process, allowing you to sell your property without the typical hassles of listing, negotiating, or waiting for financing approvals.

Ready to exit the grind of property management and focus on other ventures? Visit us at www.leancapitalllc.com to see how we can make selling your multifamily property quick and stress-free. Let us take care of the details so you can concentrate on growing your other investments and securing your financial future.

Looking for More Insights?

If you found this guide helpful, be sure to share it with fellow Vermont landlords or property managers. Stay tuned for more expert advice and resources by following Lean Capital on social media.